Theories of Corporate Governance: Agency, Stewardship etc

There are many theories of corporate governance which addressed the challenges of governance of firms and companies from time to time. The Corporate Governance is the process of decision making and the process by which decisions are implemented in large businesses is known as Corporate Governance. There are various theories which describe the relationship between various stakeholders of the business while carrying out the activity of the business.

Theories of Corporate Governance

We will discuss the following theories of corporate governance:

- Agency Theory

- Stewardship Theory

- Resource Dependency Theory

- Stakeholder Theory

- Transaction Cost Theory

- Political Theory

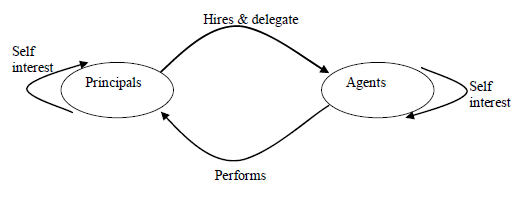

Agency Theory

Agency theory defines the relationship between the principals (such as shareholders of company) and agents (such as directors of company). According to this theory, the principals of the company hire the agents to perform work. The principals delegate the work of running the business to the directors or managers, who are agents of shareholders. The shareholders expect the agents to act and make decisions in the best interest of principal. On the contrary, it is not necessary that agent make decisions in the best interests of the principals. The agent may be succumbed to self-interest, opportunistic behavior and fall short of expectations of the principal. The key feature of agency theory is separation of ownership and control. The theory prescribes that people or employees are held accountable in their tasks and responsibilities. Rewards and Punishments can be used to correct the priorities of agents.

Stewardship Theory

The steward theory states that a steward protects and maximises shareholders wealth through firm Performance. Stewards are company executives and managers working for the shareholders, protects and make profits for the shareholders. The stewards are satisfied and motivated when organizational success is attained. It stresses on the position of employees or executives to act more autonomously so that the shareholders’ returns are maximized. The employees take ownership of their jobs and work at them diligently.

Stakeholder Theory

Stakeholder theory incorporated the accountability of management to a broad range of stakeholders. It states that managers in organizations have a network of relationships to serve – this includes the suppliers, employees and business partners. The theory focuses on managerial decision making and interests of all stakeholders have intrinsic value, and no sets of interests is assumed to dominate the others

Resource Dependency Theory

The Resource Dependency Theory focuses on the role of board directors in providing access to resources needed by the firm. It states that directors play an important role in providing or securing essential resources to an organization through their linkages to the external environment. The provision of resources enhances organizational functioning, firm’s performance and its survival. The directors bring resources to the firm, such as information, skills, access to key constituents such as suppliers, buyers, public policy makers, social groups as well as legitimacy. Directors can be classified into four categories of insiders, business experts, support specialists and community influentials.

Transaction Cost Theory

Transaction cost theory states that a company has number of contracts within the company itself or with market through which it creates value for the company. There is cost associated with each contract with external party; such cost is called transaction cost. If transaction cost of using the market is higher, the company would undertake that transaction itself.

Political Theory

Political theory brings the approach of developing voting support from shareholders, rather by purchasing voting power. It highlights the allocation of corporate power, profits and privileges are determined via the governments’ favor

We hope you liked this article. Here are few useful articles for you to read next:

- Corporate Governance Models: Anglo-American, German

- Corporate Governance and Agency Problem

- Three Levels of Management: Top, Middle and Operational

- Concept of Management: Definition and Characteristics

Click to go to RBI Grade B Preparation Page

Tags: agency theory, theories of corporate governance, stewardship theory, agency theory corporate governance, theories of governance, stakeholder theory of corporate governance, agency theory and corporate governance, stewardship theory in corporate governance, transaction cost theory corporate governance, stewardship theory of corporate governance, theories of corporate governance pdf, stewardship theory definition, what is stewardship theory, 4 key theories of corporate governance, agency theory vs stakeholder theory, stewardship corporate governance, different theories of corporate governance, resource dependence theory of corporate governance, principal agent theory corporate governance,